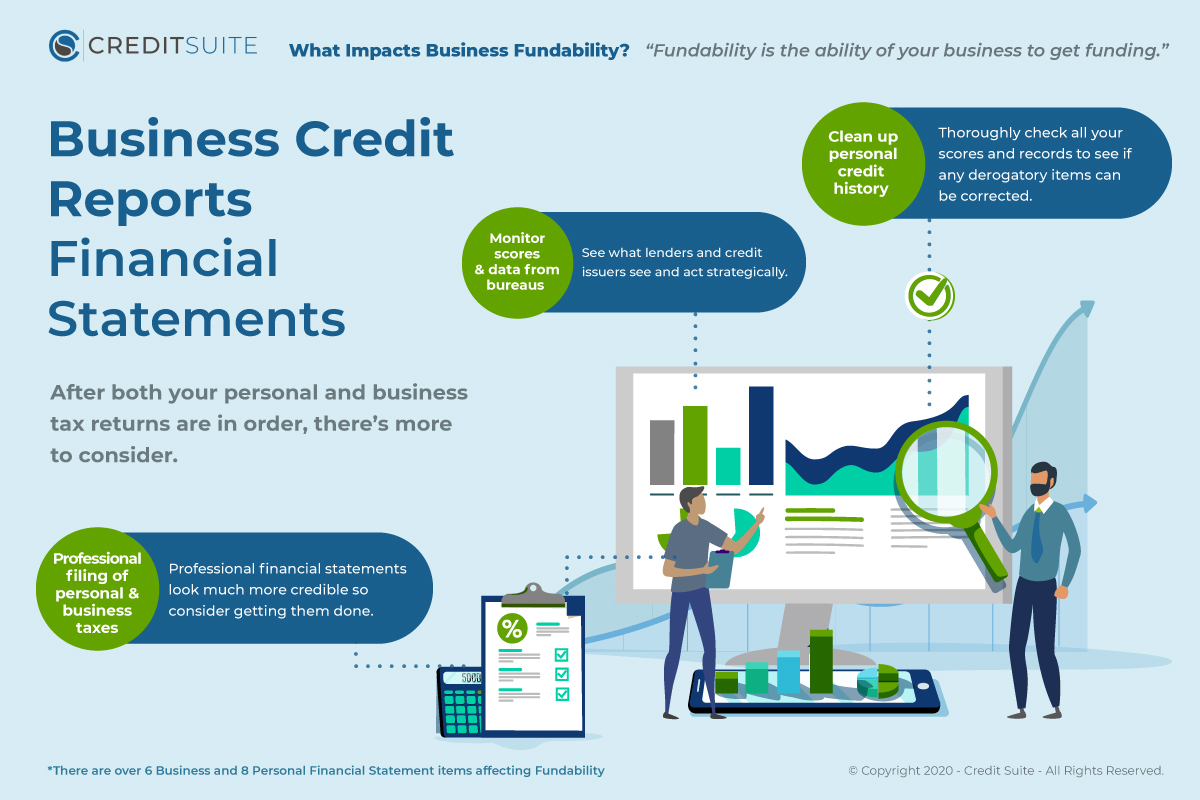

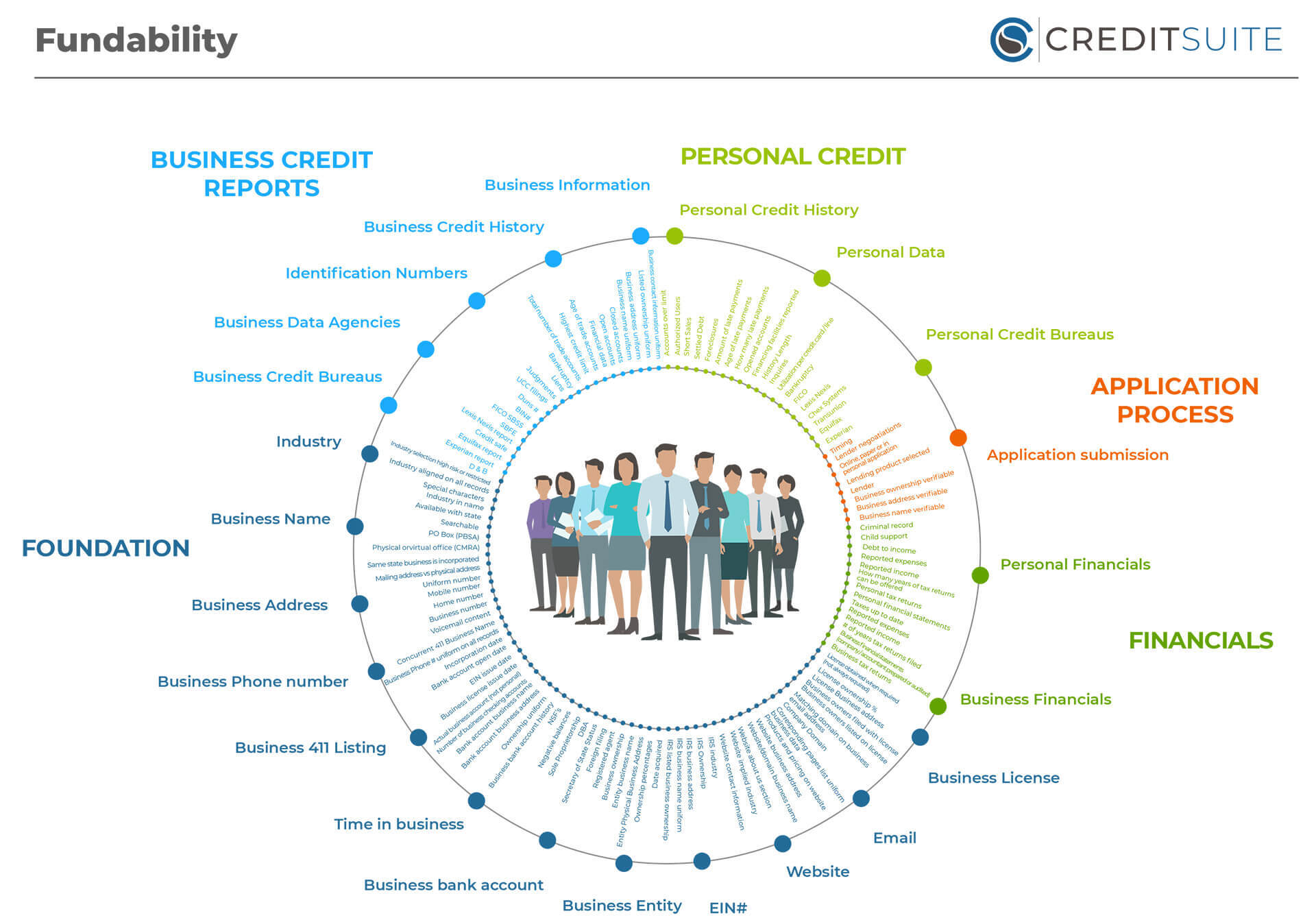

Fundability is like a puzzle. There are many different pieces that make up the complete picture. Financial statements are part of that, both business and personal. Business tax returns are just one piece of the puzzle.

The Basics of business Tax Returns and How They Affect Fundability

According to the IRS, except for partnerships, all businesses have to file an income tax return. There are different forms. The one you need to use depends on the business structure you choose. In addition to partnerships, there are sole proprietorships, corporations, S-corps, and LLCs.

Business Tax Returns for Beginners

If you are a new business owner, there are some things about paying business income taxes you need to know. They are not exactly the same as paying personal income tax. One of the major differences is that you may have to pay estimated tax.

Estimated Tax

Federal business income tax is pay-as-you-go. You have to pay the tax as you earn or receive income.

Sole proprietors and S-corps that expect to owe tax of $1,000 or more when they file their business tax return, will generally need to make estimated payments. For corporations, those that expect to owe $500 or will need to pay estimated taxes.

Documentation

You are going to have to track expenses, asset purchases, income and more. The absolute best way to do this is to implement an excellent bookkeeping system from day one. HIring a bookkeeper or bookkeeping agency is best. If you cannot do this, at least choose one of the many great accounting software options available.

With these options, you can print reports at the end of each tax period. Then just hand them over to your tax preparer.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Tax Preparation

Do not try to prepare tax returns for your business on your own. Just hire a tax professional. The cost will be well worth the time and money you save. You reduce the chances of a mistake, and you have back up if your business has to undergo an audit.

Note that your tax preparer should not be the same person as your bookkeeper or accountant. Whoever keeps the books should not do the tax returns. Larger corporations are not even allowed to have the same firm handle bookkeeping and taxes. With smaller businesses the same firm is ok, but it is not wise for the same person to do both. This helps deter and detect fraud.

This means, even if you have an in-house bookkeeper or accountant, they can prepare everything the tax preparer needs. However, they should not complete the tax forms themselves.

Other Choices You Have to Make Before Filing Your First Business Tax Return

When it comes to filing tax returns for your business, you have some choices to make. Discuss these with your tax professional thoroughly before making any decisions.

Cash vs. Accrual

You will need to choose your method of accounting. You can choose either cash or accrual basis. With the cash basis, you count income as revenue when it is collected. In the same way, you count expenses when you pay them. With accrual basis accounting, you record income when you earn it. You count expenses when they are incurred.

For example, using cash basis accounting, you don’t necessarily count revenue as soon as an item sells. You count it when you get the cash. That means, unless the buyer pays cash on the spot, you do not record revenue until the customer pays the invoice. You do not carry receivables on your books.

Using accrual basis accounting, you will record revenue when the item sells. A receivable for the invoice will go on the books..

If your business is new, you may have more unpaid expenses and more uncollected income at the end of the year. Then, it looks best for you to take those outstanding expenses as a deduction. That’s accrual basis accounting.

Yet, later on when your business is profitable, your outstanding receivables will likely be higher than outstanding expenses or payables. If you are using the accrual method, you will be recording more net income and thus paying more in taxes under the accrual method. Consider this when making your decision.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Once you decide which method to use, you will have to stick with it through the life of your business. Although, there are exceptions that allow for changes to be permitted. Also, certain businesses, like those with larger revenues or that carry inventory, do not have a choice. They must use the accrual method.

Depreciation

There are a few different options about depreciation. Discuss this thoroughly with your tax preparer to ensure you are doing what is best for your business. The first choice will be about first year depreciation. Typically depreciation on assets is written off over the course of 5 to 7 year. However, the IRS allows a first year deduction of up to $100,000 for equipment and most furniture instead. This is an election most business owners take.

However, if you do not make a profit you cannot take the $100,000 deduction. You can carry it forward to a year that you do make a profit.

Early on, you might want to think about using the slower depreciation method. Then, you can use the deductions later. At that time, there will likely be more income. You may be in a higher tax bracket than the startup phase. The depreciation deductions may come in handy.

The most important thing in making any tax decision is to discuss it with your tax professional.

Business Tax Returns and Fundability Crossover

Fundability is, in the most simple terms, the ability of your business to get funding. For a business to be fundable, it needs to be fully recognizable as an entity separate from its owner. There is a lot of crossover between fundability and business taxes.

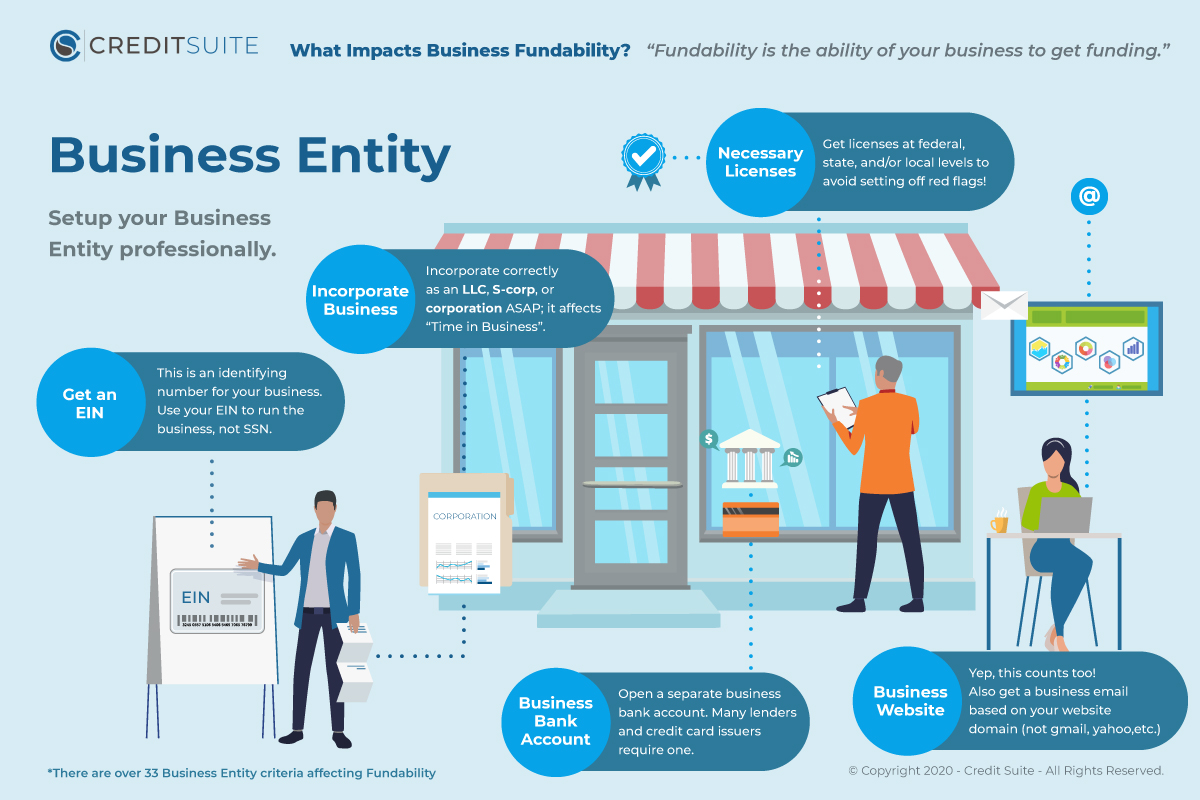

Fundability, Business Tax Returns, and Entity Type

Take the business entity choice for example. You can choose whichever you want for you taxes, but you do have to choose one. Generally, that choice will depend on your budget and needs for liability protection. Your tax advisor will be able to help you decide. However, the decision you make affects fundability as well.

For fundability purposes, you do not need to operate as a sole proprietorship. Your business needs to operate as a completely separate entity from you as the owner. To do that, you need to choose to operate as either an S-corp, LLC, or corporation.

Fundability, Business Tax Returns, and the EIN vs. SSN Saga

If you are operating as a sole proprietor, it is possible to use your SSN to file your business tax return. For fundability, you should not file a business tax return using your social security number. This is also a vital part of setting your business up to be fundable. You need an EIN. You can get one for free at IRS.gov.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Business Bank Account

To fully separate your business from yourself as the owner, you need to have a separate, dedicated business bank account. This is also helpful for tax purposes. It makes tracking business expenses much easier.

What Lenders are Looking for in Business Tax Returns

Why and how do business tax returns affect fundability? There are many factors that affect the overall fundability of a business. Credit Suite identifies 23 core principles of fundability. We break these down further into 125 fundability factors. Business financials is one of the core principles of fundability. Business tax returns are one of the factors included in this principle.

Lenders want to see that you pay your taxes, and that you are reporting things accurately to the IRS. They may not always request business tax returns. Still, if they do and you do not have things in order, it will definitely cause a problem.

Even if they do not request tax returns, they may do various background checks on your company. If they turn up that you aren’t handling your taxes responsibly, it won’t bode well for your ability to get funding.

Business Tax Returns Are Only One Piece of Fundability

Some factors affect fundability more than others. For example, consider if your business taxes are in order, but your business credit score stinks. You may struggle to get the funding you need to run your business. The same is true for how your business is set up. Say you have your taxes completely handled, but you are operating as a sole proprietorship. You are not separating your business from yourself. You use your SSN and personal contact information to file your taxes. This will cause issues with your business credit profile. That in turn causes fundability issues.

You need a tax expert to help you with your business tax return. You need a business credit expert to help you with overall fundability. Our experts can ensure you’re hitting all the core principles of fundability, and help you figure out what to do to ensure all the factors of fundability are met as closely as possible. This will give you your best shot at funding your business now, and in the future. Get a free consultation now to find out how Credit Suite can help you.

The post Business Tax Returns And Fundability appeared first on Credit Suite.