Inflation Can Affect Your Small Business – But is it Coming at all?

How does inflation affect small businesses like yours? And is it really on the horizon, anyway? Experts aren’t sure.

Prices are starting to go up. Wages are sometimes keeping up. Everyone has experienced it. You’ve undoubtedly noticed that fuel prices go up and down, or a movie costs more than it used to. And if you’ve had to have construction done, you may have noticed the price of lumber rocketing up.

It’s not your imagination. According to US News and World Report, “Prices for materials and components used in construction spiked 4% in May from April and were up over 17% from a year earlier, according to the Labor Department. Manufacturers paid 2% more last month for materials than they did in April and 21% more than in May 2020. Also in the mix: intense competition for workers that has some companies paying more to attract new hires and retain current staffers.”

What is Inflation?

According to Forbes, “Inflation occurs when prices rise, decreasing the purchasing power of your dollars.”

Seems simple enough. But it goes beyond a few higher prices on one or two goods or services. Rather, it’s an across the board increase in prices, across a sector or an industry.

In small doses, it’s actually good for the economy. It pushes consumers to buy, rather than save. Because holding onto funds means their value will diminish over time. Buying, of course, keeps small businesses viable.

Is Inflation Really Going Up?

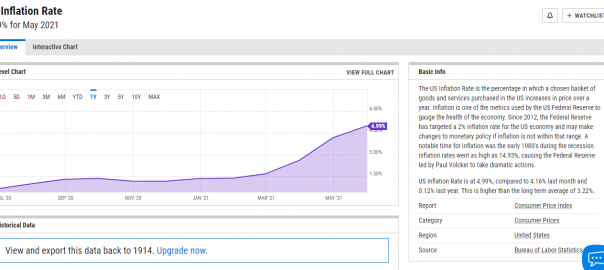

You’d better believe it. Check out this chart from YCharts. “The US Inflation Rate is the percentage in which a chosen basket of goods and services purchased in the US increases in price over a year.”

Per the chart, June of 2020 had a rate of 0.65%. But about a year later, this same metric is up to 4.99%. Particularly concerning is the fact that the rate has leapt up in the last few months – from 2.62% in March 2021, to the near-5% recorded last month.

That YCharts page goes back to April of 2017. The rate has stayed at 2.95% or less until April of 2021, when it was already over 4%. That was a historically large increase.

How Does it Affect Small Businesses?

Beyond price increases for goods and services, it can also affect how you price your own goods and services. Whether your business serves consumers, other businesses, or the government, it doesn’t matter. Inflation will cut into your profit margin. That is, unless you raise your prices. And then your business customers raise theirs, thereby perpetuating the cycle. Or your government clients print more money or borrow and rack up municipal debt. Or your individual customers buy less. They may even take their business elsewhere.

Demolish your funding problems with 27 killer ways to get cash for your business.

What if There Was Another Way to Get a Cash Infusion Without Having to Jack Up Your Prices?

What you need is business capital. This is the money or wealth needed to produce goods and services. In the most basic terms, it is money. All businesses must have to buy assets and maintain their operations. Business capital comes in two main forms: debt and equity.

Getting capital for business financing should be your concern. That’s regardless of what the economy may be doing.

Business financing is the act of leveraging debt, retained earnings, and/or equity. Its purpose is to get funds for business activities, making purchases, or investing. This is the act of funding business activities.

With lower retained earnings and perhaps less equity, it’s time to leverage debt.

How to Request a Credit Line Increase to Keep up with Inflation

Start off by understanding that some credit cards and lines won’t be eligible for an increase. For example, secured business credit cards are limited by how much you put in to secure them. Can you get a higher credit line with a secured credit card by putting in more money to secure it? It depends on the issuer.

Another class of cards and lines that tend to not be eligible for increases? New credit cards and lines. Providers like Capital One won’t increase a credit lines for new accounts opened within the past several months.

Providers may also want to allow for some time between credit line increase requests. But the amount of time in between isn’t a standard in the credit industry.

Requesting a Credit Line Increase

Let’s operate under the assumption that the standard reasons for denial do not apply. How do you actually ask for a credit line increase?

First off, you need to approach this task from a position of strength. This means paying off your balances as much as possible. It also means waiting for at least one billing cycle to elapse so the newer, lower balance will show up.

Reporting all your income will also be helpful. Because your card or credit line issuer only wants to know if you can pay them back.

The provider may very well ask why you’re looking for a credit line increase. And your provider may ask for some documentation, such as annual revenue and expenses. Having this information at your fingertips will go a long way toward getting to a ‘yes’.

Demolish your funding problems with 27 killer ways to get cash for your business.

Asking for a Credit Line Increase – How to

In general, you can make your request either by phone or online. At Bank of America, for example, you sign into online banking. Go to Account Summary, then Card Details, and then Request a credit line increase. Or you can call their Customer Service Info Line, at (800) 732-9194.

Don’t ask for an enormous amount. If your credit limit is currently $10,000, you’re most likely not going to get an increase to $50,000 all in one shot. But an increase to $15,000? If your balances are good, then it’s very possible.

Credit Line Increases: the Pros and Cons

The most obvious pro is getting access to more debt for business financing. But recognize one major con – the likelihood of a hard inquiry. Hard inquiries can bring your credit score down. But if you truly need the increase and have a good credit score to begin with, then requesting an increase is a good idea. The positives, in this instance, would outweigh the negatives.

Demolish your funding problems with 27 killer ways to get cash for your business.

More Business Financing Choices to Combat Inflation

Most of our business financing options can help address the inflationary elephant in the room. Consider our Credit Line Hybrid. You can get several business credit cards, applied for at the same. They provide 0% rates and cash out capability. If you or a credit partner have good personal credit scores, then these are within reach.

Address Inflation Head-on By Borrowing NOW

If interest rates are climbing, borrowing today could say money over borrowing tomorrow. This goes for more than credit cards and lines, but also business loans.

Or Invest NOW

Keeping rapidly depreciating cash on hand won’t do you any favors. Of course you will always need some cash on hand. But if you can pump some of it into an exchange-traded fund or a mutual fund, you can be putting your surplus to work.

But two caveats apply. One, past performance is never a guarantee of future results. And two, always talk to a financial professional before making any investments.

Takeaways

The economy is a little like the weather. It will change, whether we want it to, or not. But you can take some steps to help your small business, both now and in the future. Your small business can get the upper hand over inflation, and come out stronger than ever.

The post Inflation and Your Small Business appeared first on Credit Suite.